The impact of means testing on Disability Allowance, Disablement Pension and other social welfare schemes

May 29 2024, 11:51am

Opening Statement to Oireachtas Joint Committee on Social Protection, Community and Rural Development, and the Islands by Fleachta Phelan Policy Advocacy Manager with the Disability Federation of Ireland

29 May 2024

Thank you for the invitation to speak to the committee. DFI is a federation of over 120 disability organisations across Ireland. To inform our input into this Committee I held a short focus group with members on the experience and impact of means testing on the communities they serve.

Firstly it’s important to remember the context. The social protection rates currently provided to disabled people are insufficient, especially given the extra costs they live with. Last year, one in two people (44.7%) who were unable to work due to long-standing health problem (disability) lived in deprivation[1], unable to afford basic essentials. This is shocking and cannot be allowed to continue – we can and should make different policy choices.

I note that in an earlier hearing the Department of Social Protection highlighted the effectiveness of our social protection system at alleviating poverty, citing recent SILC data. But the ‘at risk of poverty’ rate for those unable to work due to health problems is almost three times higher than the national average – 27.3% compared to 10.6%[2]. This shows that our system isn’t delivering for people with disabilities who cannot work.

Means-testing compounds and perpetuates this.

At an operational and administrative level there are many issues, which Sandra and Padraig outline. One individual described the experience of submitting to means-testing to me thus – “you feel degraded, like you are begging”.

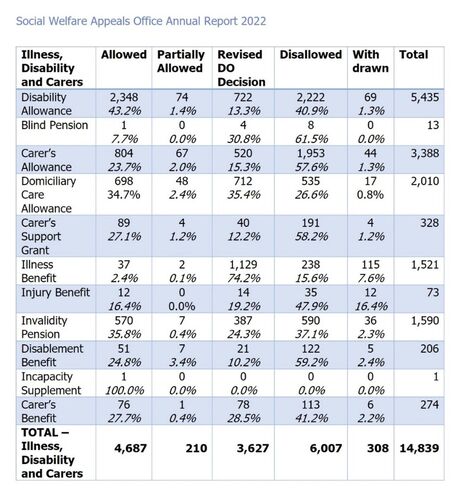

Moreover unfortunately the experience for thousands of applicants every year is that they get refused on the first instance and have to appeal. In 2022 43.2% of Disability Allowance appeals were allowed – this was the highest ‘allowed’ rate for appeals across all payment types.[3]

The experience of means-testing reviews also causes difficulty for families that are already struggling. Our member Down Syndrome Ireland reports many of their members being reviewed and losing supports in recent years, in spite of the ongoing cost of living crisis and the many disability-related costs that households live with.

Household Means Assessment and Need for Individualisation

People with disabilities are means-tested based on the incomes of those they live with – family members, romantic partners or housemates. This creates a form of financial dependency and denies people’s right to independent living. It perpetuates an assumption that disabled people should rely financially on parents or siblings for the rest of their lives, and families will absorb the extra Cost of Disability.

In the context of romantic relationships, this is often referred to as the ‘love tax’. If a person with a disability moves in with their partner they may lose some or all of their supports due to their partner’s income, despite still being disabled and having all the same costs they had before. Some European countries, like Belgium, have changed this in recent years.[4]

Unfortunately, this is also, as one of our members describes it, “a recipe for domestic violence” - where a disabled partner has to ask their partner for money, rather than having their own independent income. This is particularly problematic given that women with disabilities are much more likely to experience domestic violence.

Another issue is the absolute nature of means-testing thresholds and the cliff edges. For example, Cystic Fibrosis Ireland supported someone recently who was refused a Disability Allowance payment due to their household income being €4 over the threshold. The impact of this for the individual was financially devastating. At minimum, there should be a tapered approach and a consideration of partial rates.

Income Disregards and Secondary Benefits

Ireland has one of the lowest disability employment rates in Europe, and this is not unrelated to means-testing and the loss of supports. The fear of loss of a medical card is a huge barrier to disabled people taking up work. Medical card entitlement should be based on medical need rather than means-testing, something the OECD has also recommended.[5]

In many EU countries disabled people don’t lose their disability supports when they work, unlike in Ireland.[6] This is also why people on disability payments’ income tends to stay around the income disregard levels. The income disregard levels need to increase, as should the means allowance for those who cannot work, to allow for other forms of income, such as pensions from parents, inheritance etc.

Capital Disregard and the Importance of Savings

Disability allowance has a higher capital disregard than other payments, a positive acknowledgement of the extra economic vulnerabilities that disabled people live with. However this has not been reviewed since 2007, despite huge escalations in costs since (notably in housing), and the recent high levels of inflation. Moreover this can cause trouble for people moving across schemes, or see disabled people being refused applications for Additional Needs Payments and told to use their hard-earned savings instead.

Solutions and ways forward

To better support disabled people with the extra cost of disability, and ensure they do not continue to live in deprivation, Ireland should:

- Assess the cost of means testing and consider a move to universal payments, or at minimum a much higher household income cut off, bearing in mind the extra Cost of Disability.

- A disabled person should be means tested only on their own income and means, not that of their family member, partner or anyone else they live with.

- Provide a medical card and other entitlements like free travel pass based on medical need and disability status.

- Bring in a universal non-means-tested Cost of Disability payment of €40 a week, starting with social protection recipients.

- Develop tapered supports for those who may be just above the cut-off rates, to mitigate cliff edges.

Consolidation of means testing would also be welcome – many disabled people have to fill out separate forms when applying for different supports from the state – be it medical card, fuel allowance, social protection, a housing adaptation grant etc. Reducing this duplication would save time, administration costs for the state, and stress for the applicant.

Finally I know this committee also held hearings on energy poverty this year, and I wanted to briefly highlight the higher levels among disabled people – due to low employment and income levels, and higher energy usage requirements. This is evident every year in the annual energy deprivation indicators[7], so I wanted to stress the importance of considering disabled people’s needs when addressing energy poverty.

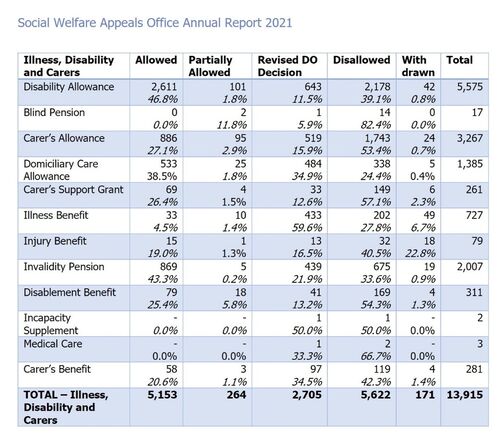

Appendix: Social Welfare Appeals Data

Information on disability-related appeals in 2022

Source: Social Welfare Appeals Office Annual Report 2022, pages 31-32

Information on disability-related appeals in 2021

Source: Social Welfare Appeals Office Annual Report 2021, page 31

[1] https://www.cso.ie/en/releasesandpublications/ep/p-silc/surveyonincomeandlivingconditionssilc2023/poverty/

[2] Op Cit.

[3] See Tables below from 2022 and 2021 Social Welfare Appeals Office

[4] https://www.edf-feph.org/belgium-eliminates-the-love-tax/

[5] OECD, 2021, p 19, DISABILITY, WORK AND INCLUSION IN IRELAND https://www.oecd.org/employment/disability-work-and-inclusion-in-ireland-74b45baa-en.htm

[6] https://www.edf-feph.org/report-social-protection-schemes-for-persons-with-disabilities-across-europe/

[7] https://www.cso.ie/en/releasesandpublications/ep/p-silced/surveyonincomeandlivingconditionssilcenforceddeprivation2023/enforceddeprivation/